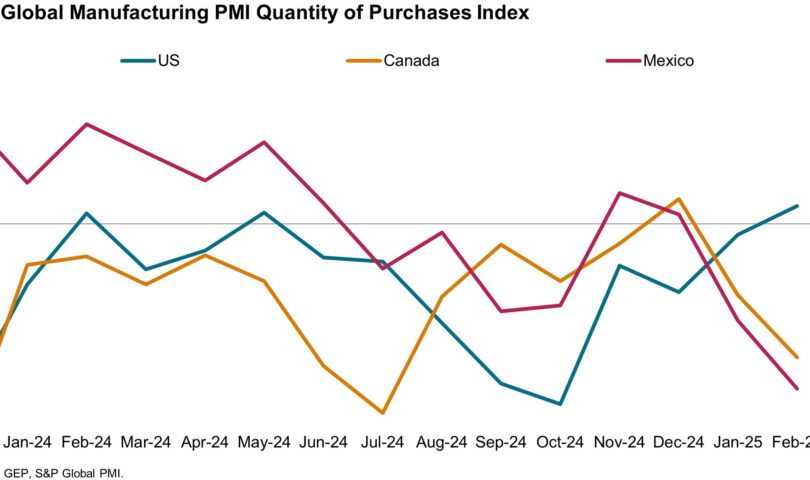

The GEP Global Supply Chain Volatility Index, a key indicator monitoring demand, shortages, transportation costs, inventories, and backlogs based on a monthly survey of 27,000 businesses, dropped to -0.45 in February from -0.21 in January. This is the lowest level since July 2023. Asian supply chains are operating at full capacity due to export growth in China, Taiwan, and India, driving factory activity. In contrast, European factories are reducing inventories as the industrial slowdown persists, although there are some tentative signs of recovery. Located in Clark, N.J., this information was released on March 12, 2025, by PRNewswire. The global index shows an increase in underutilized supply chain capacity, but regional data reveals significant geographic variations. In the U.S., manufacturers are experiencing increased demand for raw materials and components due to preparations for orders and efforts to avoid higher costs from additional tariffs. This has led to accelerated sales growth and increased procurement as customers try to anticipate price and supply challenges from tariffs. In contrast, Mexican and Canadian manufacturers have significantly reduced their purchases in response to a sharp decline in exports to the U.S. Companies held back from placing orders due to the threat of tariffs and uncertainty surrounding trade policies. In Europe, manufacturers are reducing inventories as the industrial sector remains slow, leading to underutilized supply chains. However, there are signs of recovery as factory demand for inputs weakened to its lowest level in two-and-a-half years.

In Asia, supply chains are operating at full capacity, with strong export growth reported in countries like China, Taiwan, and India. U.S. manufacturers are rushing to secure materials amidst tariff uncertainties, while Canadian and Mexican suppliers are experiencing weaker export demand. It is crucial for companies to remain flexible by diversifying supply sources and optimizing inventory strategies to navigate the current volatility.

For more information, visit www.gep.com/volatility.

The next release of the GEP Global Supply Chain Volatility Index will be at 8 a.m. ET on April 10, 2025.

About the GEP Global Supply Chain Volatility Index: The GEP Global Supply Chain Volatility Index, produced by S&P Global and GEP, is derived from S&P Global’s PMI surveys and provides insights into supply chain capacity and volatility. A value above 0 indicates stretched supply chain capacity and increasing volatility, while a value below 0 indicates underutilized capacity and reduced volatility. Regional indices are also available for Europe, Asia, North America, and the U.K.