In March, global supply chains saw a surge in spare capacity, reaching the highest level since May 2020, indicating worsening conditions for manufacturers worldwide. Factories in the US, Mexico, and Canada experienced significant setbacks due to tariffs, with Canada being the most affected. The UK also faced a contraction in supplier activity, signaling considerable manufacturing weakness.

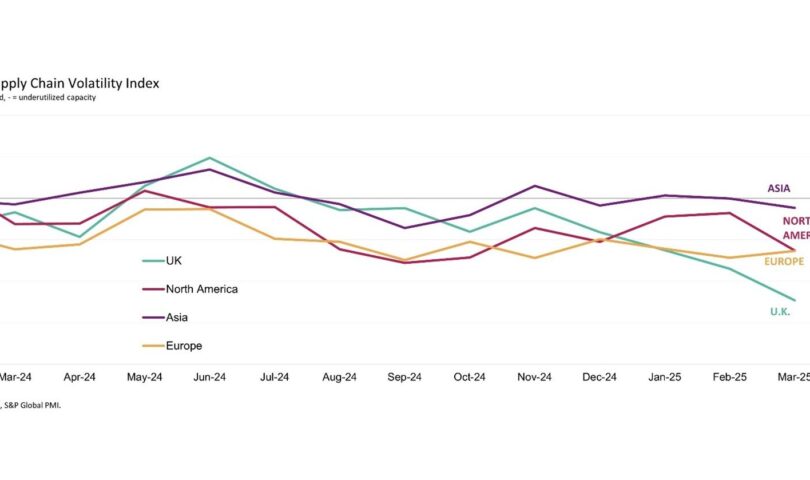

The GEP Global Supply Chain Volatility Index, a leading indicator tracking various supply chain factors, decreased for the third consecutive month in March, reaching its lowest value in almost five years. This suggests the highest degree of spare capacity in global supply chains since the peak of the COVID-19 pandemic in 2020.

A notable finding from GEP’s data was a sharp decline in companies stocking up on inventory, with manufacturers’ stockpiling at its lowest in nine years. This reflects caution among procurement leaders regarding future demand.

According to John Piatek, vice president of consulting at GEP, the decrease in supplier activity in March was attributed to tariffs and uncertainty, particularly affecting North America. Companies are now actively seeking ways to cut costs, shift tariffs to suppliers, and mitigate risks in their supply chains.

In the UK, supplier spare capacity rose for the fourth consecutive month to levels seen only during significant crises like the COVID-19 pandemic or the global financial crisis. Factories took aggressive measures to reduce stock and spending in March, indicating a potential downturn in the country’s industrial sector. European supply chains showed signs of slack, with demand for raw materials, commodities, and components decreasing at the slowest rate in almost three years. In contrast, Asian supply chains were operating at full capacity, with increased procurement activity in China and India.

Key findings for March 2025 include stable global demand for materials and components, decreased reports of safety stockpiling, and below-average global material shortages. Labor shortages remained contained, while transportation costs fell to their lowest in the year.

Regional supply chain volatility varied, with North America experiencing spare capacity, Europe showing signs of recovery, and the UK facing a slowdown. Asian supply chains were operating at full capacity.

For more information, visit www.gep.com/volatility. The next release of the GEP Global Supply Chain Volatility Index will be on May 13, 2025.

The GEP Global Supply Chain Volatility Index is a collaboration between S&P Global and GEP, derived from PMI surveys sent to companies worldwide. The index indicates whether supply chain capacity is being stretched or underutilized.

GEP provides procurement and supply chain solutions to global enterprises, while S&P Global offers essential intelligence for decision-making. Any unauthorized use of the data provided in the report is prohibited without consent from S&P Global. S&P Global Disclaimer and Media Contacts

S&P Global, including its affiliates, shall not be held liable for any errors, inaccuracies, omissions, or delays in the data contained herein. Any reliance on this information is at the user’s own risk, and S&P Global disclaims any duty or obligation for actions taken based on the data. In no event shall S&P Global be responsible for any special, incidental, or consequential damages resulting from the use of the data. The trademarks Purchasing Managers’ Index™ and PMI® belong to S&P Global Inc, or are licensed to S&P Global Inc and its affiliates.

This content is published by S&P Global Market Intelligence and not by S&P Global Ratings, a separate division of S&P Global. Reproduction of any information, data, or material, including ratings, is prohibited without prior written permission from the relevant party. The Content Providers, including affiliates and suppliers, do not guarantee the accuracy, adequacy, completeness, timeliness, or availability of any content. They are not liable for any errors or omissions, regardless of the cause, and shall not be responsible for any damages, costs, expenses, legal fees, or losses resulting from the use of the content.

For media inquiries, please contact:

– Derek Creevey, Director of Public Relations at GEP

Email: [email protected]

Phone: +1 646-276-4579

– Joe Hayes, Principal Economist at S&P Global Market Intelligence

Email: [email protected]

Phone: +44-1344-328-099

Photo – https://mma.prnewswire.com/media/2661227/Picture1.jpg

Photo – https://mma.prnewswire.com/media/2661228/Picture2.jpg

Logo – https://mma.prnewswire.com/media/518346/GEP_Logo.jpg

In conclusion, S&P Global emphasizes that users should exercise caution and seek permission before using any content or data provided. The company and its affiliates strive for accuracy and timeliness but cannot guarantee error-free information. For further inquiries or information, feel free to reach out to the media contacts listed above. The following content will be rewritten:

Original: “The quick brown fox jumps over the lazy dog.”

Rewritten: “The fast brown fox leaps over the sleeping dog.”