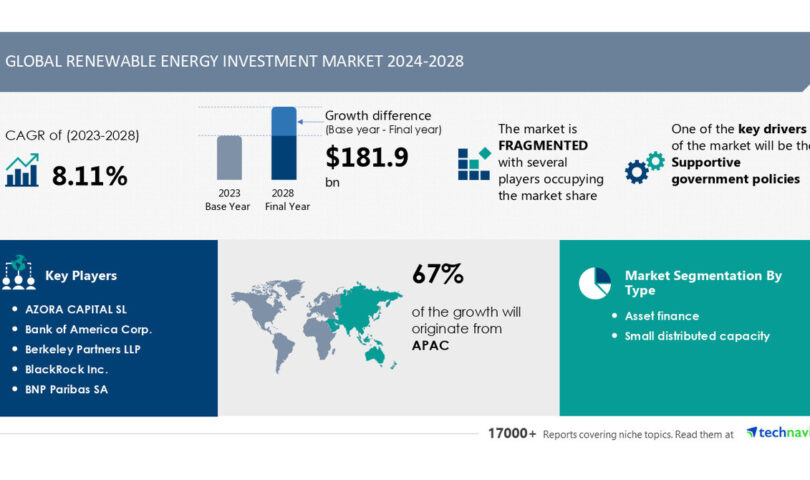

The global renewable energy investment market is projected to grow by USD 181.9 billion from 2024-2028, with a CAGR of 8.11%. Supportive government policies are driving market growth, leading to increased spending on utility-scale renewable energy projects. However, competition from fossil fuels presents a challenge. Key players in the market include AZORA CAPITAL SL, Bank of America Corp., Berkeley Partners LLP, BlackRock Inc., BNP Paribas SA, and others. Technavio has released a report on this market evolution, powered by AI. Our latest market report provides insights on current trends, growth opportunities, and strategic analysis. Click here to access the free sample report PDF.

Key Market Trends Fueling Growth:

– The renewable energy investment market is growing rapidly due to energy crises and affordability concerns.

– The EU leads in deploying solar and wind technologies, with biofuels also in demand.

– Policy developments and clean energy laws are driving investment in utility-scale projects.

– Challenges such as labor costs and regulatory hurdles persist, but renewable energy sources are becoming more competitive.

– AI is optimizing renewable energy systems, and grid resilience is a focus area.

Insights on how AI is driving innovation, efficiency, and market growth can be requested here.

Market Challenges:

– The renewable energy market faces challenges such as biofuel supply, policy developments, and rising interest rates.

– Utility-scale projects benefit from state and local policies but face obstacles in determining cost-effective energy sources.

– Despite challenges, renewable energy remains competitive, but delayed projects and offshore wind growth are concerns.

– Infrastructure investments and federal support are crucial for a smooth transition to a decarbonized energy system. Investing in renewable energy facilities requires a significant upfront cost, and the electricity output from sources like solar and wind can vary. Solar PV installations, for example, require a large initial investment despite decreasing material costs. Additionally, covering large areas with solar panels to generate sufficient electricity adds to the overall cost.

The renewable energy investment market report delves into market segmentation by type, including asset finance and small distributed capacity, as well as by geography, covering regions such as APAC, North America, Europe, South America, and the Middle East and Africa. Asset finance, the largest segment, involves financial service vendors like the Clean Energy Finance Corporation that support clean energy projects.

The renewable energy market is experiencing growth as the world shifts towards cleaner energy sources. Solar and wind technologies are leading the charge, with biofuels also playing a role. Policy developments and investments in renewable energy infrastructure are driving capacity additions and decarbonization efforts. Generative artificial intelligence is optimizing energy production, while grid resilience is a key consideration as renewables make up a larger portion of the energy mix.

Technavio is a global technology research and advisory company that provides insights into emerging market trends to help businesses identify opportunities and develop effective strategies. With a team of specialized analysts and a vast report library, Technavio serves clients worldwide, including Fortune 500 companies.